Mortgage Blog

Mortgage It Right!

Volatility Indicator

August 26, 2016 | Posted by: Kelleway Mortgage Architects

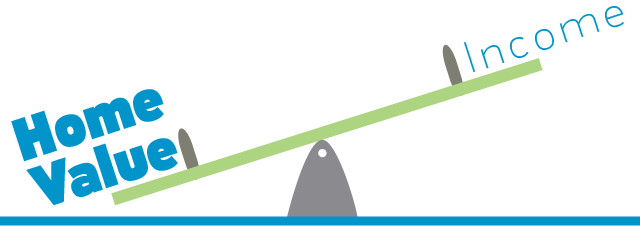

Volatility Indicator: When Your Home Generates More Dollar Value than Your Annual Employment

According to a BC mathematician, Jens von Bergmann, Vancouver home owners netted $25 billion last year (2015) alone compared to employees in the city earning $18 billion in employment income.

“This is obviously problematic because soaring house prices need to be underpinned by an abundance of well-paying jobs and rising paycheques. And while those two cities (Vancouver & Toronto) currently account for all new job gains, wage growth has been meagre,” said Aaron Hutchins, Maclean’s, journalist and market observer.

By definition, volatility means circumstances are liable to change rapidly and unpredictably, especially for the worse in an extreme way. To achieve stability in the face of real estate market volatility, my advice is to be alert, informed and prepared for the worst - while hoping the best prevails.

Indicators to look for in your geographic market are:

- - Population and financial migration in and out of real estate markets (from local and global sources)

- - Price acceleration and overvaluation of properties (overheated demand is signalled when the number of sales outpaces new listings and selling prices often exceed list prices)

- - Overbuilding of properties (overheating the supply of unsold new housing while vacancy rates climb)

- - Employment rate gains, losses and their affect on household income (economic conditions)

- - Mortgage interest rate movement (increases and decreases)

For example, CMHC’s third quarter Housing Market Assessment report highlights that Vancouver and Toronto are showing signs of overheating, price acceleration and overvaluation. In contrast, the oil-dependent provinces hit by low energy prices have shown indications of overbuilding in Calgary, Saskatoon and Regina. CMHC has developed an analytic framework to test for the number of signals, their intensity and their persistence over time in order to evaluate housing market conditions.

For details on your location, please refer to the full report.

What's the Next Step for You?

1) Keep us in mind and on hand in case anyone you know runs into the same sort of situaltion.

2) Share this post with your friends and family because you never know when the info could come in handy.

3) Call or Email Us just to connect and get started talking about your plans. (see below)

4) Sign Up for Glen's Perspective newsletter > Click here

Glen Kelleway, BSc, AMP, Senior Mortgage Planner & Owner

If you would like us to contact you by phone or email, please click Contact Us Kelleway Mortgage Architects will get back to you within one business day.

Phone: 604-476-0053![]() 604-476-0053

604-476-0053

Toll Free within North America: 1-866-476-0053![]() 1-866-476-0053 FREE

1-866-476-0053 FREE

Email: glen@mtgitright.com

(The first time you use this email address, please call first to validate yours. Otherwise, our SPAM filters will block your email and we will not see it.)

Join us on Facebook: > Click here

Send us a comment or question, we'd be happy to hear from you! Or call 604 476 0053 or 1 866 476 0053

Blog Categories

- Main Blog Page

- Alt-A Lending Options (1)

- Announcements (18)

- Builder's Lien Removal (1)

- Community Relations (1)

- COVID-19 and Mortgage Deferral (8)

- Credit & Debt (15)

- Down Payment (2)

- Education and Courses (4)

- Financial Intelligence (17)

- Foreclosures (1)

- Fun Tips (52)

- Home Improvement (2)

- Legal Considerations (2)

- Line of Credit (LOC) (1)

- Mortgage Lenders (2)

- Mortgage Renewals (10)

- Mortgage Trends & Rates (14)

- Mortgage Types (13)

- Moving to Next Home (8)

- My Mortgage Planner App (5)

- Price per Square Foot (1)

- Prize Draw (41)

- Property Types (11)

- Purchase + Improvement (9)

- Qualifying for a Mortgage (14)

- Real Estate Contracts (2)

- Real Estate Market (12)

- Real Estate Taxes (7)

- Recipes & Serena's Tasty Tidbits (5)

- Relocation into Canada (1)

- Selling Your Home (3)

Blog Archives

- July 2022 (1)

- May 2022 (5)

- April 2022 (5)

- March 2022 (5)

- February 2022 (4)

- January 2022 (6)

- December 2021 (5)

- November 2021 (5)

- October 2021 (4)

- September 2021 (4)

- July 2021 (6)

- June 2021 (7)

- May 2021 (4)

- April 2021 (4)

- March 2021 (5)

- February 2021 (4)

- January 2021 (5)

- December 2020 (6)

- November 2020 (4)

- October 2020 (5)

- September 2020 (3)

- August 2020 (2)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (6)

- March 2020 (10)

- February 2020 (5)

- January 2020 (8)

- December 2019 (4)

- November 2019 (6)

- October 2019 (6)

- September 2019 (3)

- August 2019 (4)

- July 2019 (5)

- June 2019 (3)

- May 2019 (5)

- April 2019 (5)

- March 2019 (5)

- February 2019 (8)

- January 2019 (8)

- December 2018 (4)

- November 2018 (7)

- October 2018 (7)

- September 2018 (5)

- August 2018 (5)

- July 2018 (6)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- December 2017 (1)

- February 2017 (2)

- October 2016 (4)

- September 2016 (1)

- August 2016 (6)

- June 2016 (5)

- April 2016 (1)

- March 2016 (4)

- December 2015 (2)

- November 2015 (1)

- June 2015 (5)

- April 2015 (4)

- January 2015 (1)

- December 2014 (1)

- October 2014 (2)

- July 2014 (4)

- April 2014 (1)

- October 2011 (1)