Mortgage Blog

Mortgage It Right!

Category: Qualifying for a Mortgage (14 posts)

7 Steps for Mortgage Prep

November 23, 2021 | Posted by: Rachel Moffat

Step 1 - Your Credit Score Whether you qualify for a mortgage through a bank, credit union or other financial institution, you should be aiming for a credit score of 680 for at least one bo ...

read more5 Approval Roadblocks You Should Know

September 23, 2021 | Posted by: Rachel Moffat

When buying a home, there is nothing worse than having your mortgage broker or lawyer call and say “there is a problem”. If you have found your dream home and negotiated a fair price, a ...

read moreWhat to Know if You’re New to Canada

May 13, 2020 | Posted by: Rachel Moffat

Canada has seen a surge of international migration over the last few years. With all these new faces in town wanting to plant roots in this great country, we wanted to touch base on some of the detail ...

read moreHow to Leverage Your RRSPs to Buy Your First Home

February 23, 2020 | Posted by: Rachel Moffat

Are you in the market for your first home? Dreaming of a space you can call your own? If you are an eligible first time home-buyer, then contributing to your RRSP’s before the March 1 deadline c ...

read moreAn Age Old Debate: Who Has the Advantage When Buying a Home?

December 16, 2019 | Posted by: Roar Solutions

Just about anytime two people of different generations discuss entering the real estate market, the question arises: Who had it easier trying to get into the housing market? Often the younger of the t ...

read moreHow Do We Get Into This Housing Market?

November 20, 2019 | Posted by: Glen Kelleway

We help people who are: • Just starting adult life • Starting a new life in this province or in Canada • Transitioning from renter to homeowner We calm hom ...

read moreMortgage Brokers Can Help You Get Financing for Every Stage of Your Life

September 25, 2019 | Posted by: Glen Kelleway

Mortgage Brokers Can Help You Get Financing for Every Stage of Your Life Buying a home can feel like a journey. Whether it’s your first or your 10th, there are many steps to go throug ...

read more5 Mortgage Tips to Help You Afford a Home

July 24, 2019 | Posted by: Glen Kelleway

Buying a home has become more difficult now than ever— maybe this is not news to you! Recent lending stress-test measures, increases in housing prices in major cities, and the continue ...

read moreUPDATE - Follow-up on Changes to Federal Government Rules & Regulations

February 2, 2017 | Posted by: Glen Kelleway

Is your down payment less than 20% of the financing value of your home? If so, your mortgage falls into the “default insured mortgage” category and must be insured by one of the ...

read moreMerry Xmas...Higher Mortgage Interest Rates Expected!

October 31, 2016 | Posted by: Glen Kelleway

Thinking of refinancing? You may want to consider doing that sooner than later.After November 30, 2016, expect mortgage interest rates to likely increase by at least a quarter&nb ...

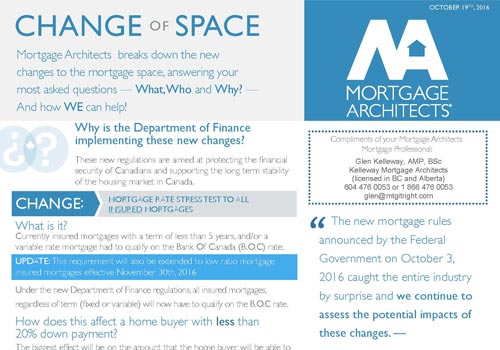

read moreUpdate: 2016 Canadian Government Rule Change - Stress Test for Borrowers

October 19, 2016 | Posted by: Glen Kelleway

...

read more2016 Government Changes - in Effect!

October 17, 2016 | Posted by: Glen Kelleway

2016-10-14_GCK_MA_flyer_-_Rule_Change.pdf ...

read moreOctober 2016 Qualification Rate Imposed by Canadian Government

October 4, 2016 | Posted by: Glen Kelleway

Monday, October 3, 2016Finance Minister Bill Morneau announced some new changes that will affect the mortgage industry.Monday, October 17, 2016New qualification rate goes into effect and it ...

read moreHow You Square Up to Qualify for a Mortgage

June 29, 2015 | Posted by: Glen Kelleway

From the lender's viewpoint, borrowers need to meet certain criteria in order to qualify for a loan with the best terms available. In order for us to arrange mortgages for borrowers, we often review t ...

read moreBlog Categories

- Main Blog Page

- Alt-A Lending Options (1)

- Announcements (18)

- Builder's Lien Removal (1)

- Community Relations (1)

- COVID-19 and Mortgage Deferral (8)

- Credit & Debt (15)

- Down Payment (2)

- Education and Courses (4)

- Financial Intelligence (17)

- Foreclosures (1)

- Fun Tips (52)

- Home Improvement (2)

- Legal Considerations (2)

- Line of Credit (LOC) (1)

- Mortgage Lenders (2)

- Mortgage Renewals (10)

- Mortgage Trends & Rates (14)

- Mortgage Types (13)

- Moving to Next Home (8)

- My Mortgage Planner App (5)

- Price per Square Foot (1)

- Prize Draw (41)

- Property Types (11)

- Purchase + Improvement (9)

- Qualifying for a Mortgage (14)

- Real Estate Contracts (2)

- Real Estate Market (12)

- Real Estate Taxes (7)

- Recipes & Serena's Tasty Tidbits (5)

- Relocation into Canada (1)

- Selling Your Home (3)

Blog Archives

- July 2022 (1)

- May 2022 (5)

- April 2022 (5)

- March 2022 (5)

- February 2022 (4)

- January 2022 (6)

- December 2021 (5)

- November 2021 (5)

- October 2021 (4)

- September 2021 (4)

- July 2021 (6)

- June 2021 (7)

- May 2021 (4)

- April 2021 (4)

- March 2021 (5)

- February 2021 (4)

- January 2021 (5)

- December 2020 (6)

- November 2020 (4)

- October 2020 (5)

- September 2020 (3)

- August 2020 (2)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (6)

- March 2020 (10)

- February 2020 (5)

- January 2020 (8)

- December 2019 (4)

- November 2019 (6)

- October 2019 (6)

- September 2019 (3)

- August 2019 (4)

- July 2019 (5)

- June 2019 (3)

- May 2019 (5)

- April 2019 (5)

- March 2019 (5)

- February 2019 (8)

- January 2019 (8)

- December 2018 (4)

- November 2018 (7)

- October 2018 (7)

- September 2018 (5)

- August 2018 (5)

- July 2018 (6)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- December 2017 (1)

- February 2017 (2)

- October 2016 (4)

- September 2016 (1)

- August 2016 (6)

- June 2016 (5)

- April 2016 (1)

- March 2016 (4)

- December 2015 (2)

- November 2015 (1)

- June 2015 (5)

- April 2015 (4)

- January 2015 (1)

- December 2014 (1)

- October 2014 (2)

- July 2014 (4)

- April 2014 (1)

- October 2011 (1)