Mortgage Blog

Mortgage It Right!

Tame Your Debt Dragon

January 20, 2015 | Posted by: Kelleway Mortgage Architects

It’s the start of a New Year...out with the old, in with the new...unless the “old” includes some lingering debt from 2014.

Perhaps it’s time to seek some friendly guidance and advice?

Here are some tips on how we can help you develop Clarity, Expertise and Strategy to tame your debt dragon!

Clarity

Over the years, Heather and I have tried and tweaked our own ways of handling and tracking business and personal finances.

Here’s what we found simple and useful.

1) Pay Bills

2) Collect Receipts

3) Sort Receipts

4) Bookkeeping

5) Analysis

6) Track then Budget

7) Income Tax

8) Store Your Financial Information

1) Pay Bills – Monitor your bank statements regularly. Whenever possible, pre-pay your bills via online banking three days prior to their due date. Within a day of when credit card statements arrive in the mail, or electronically in your inbox, pre-schedule payments online. Arrange pre-authorized debits for as many regular payments as possible to minimize processing time. If dealing with regular suppliers, consider putting some on monthly retainers to help manage your monthly cash flow – and prevent a backlog of unpaid invoices!

2) Collect Receipts – Always ask for a receipt, whether for business or personal expense, and then have a communal “dumping” spot to collect them.

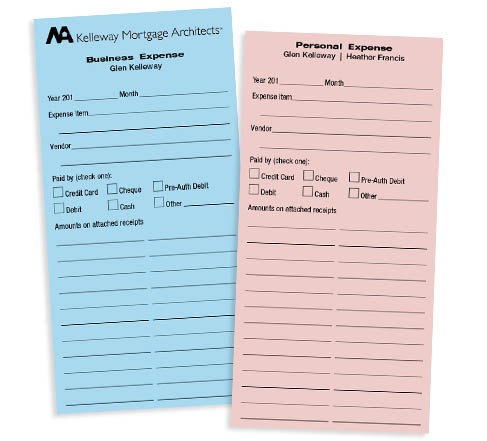

3) Sort Receipts – Heather has designed and printed tear-off pads of small summary slips, blue for business receipts and pink for personal. (PDF attached) Every receipt gets stapled to one or the other slip and completed according to type of purchase and vendor. These receipts are then sorted according to method of payment (i.e., a folder each for credit card, cash, cheque, debit, pre-authorized debit, etc.). Each month, hard copy bank and credit card statements are collected in folders. Digital copies from online banking, commission statements, invoices, receipts and payments are also filed electronically in electronic folders organized by month. By the first Thursday of each month, Heather downloads current transaction reports from online accounts so that all banking and credit card transactions are represented from the 1st to the end of the previous month.

4) Bookkeeping – We have a bookkeeper who comes to our office and enters all the transactions into QuickBooks (i.e., accounting software) each month. Within 3-4 hours, we have a monthly Profit & Loss Statement and a Balance Sheet for both our business and personal income, expenses, assets, liabilities and equity. We also generate a year-to-date Profit & Loss report. (Perhaps you’ve heard of “garbage in, garbage out”? No matter how competent the bookkeeper, the validity of reports is dependent upon the accuracy of the input data. In the beginning years of our business, we used custom spreadsheets to track our P&L. We later changed to a common accounting software package, i.e., QuickBooks, so that we could delegate some of the processing to a bookkeeper.)

5) Analysis – Our business is cyclical with peaks and valleys of income and expense. Therefore, we review the current report and compare it to reports from last month, year-to-date and sometimes previous years. Sometimes we make a game of “Where can we find another $100 per month?” For example, re-negotiating telecommunication bills are a good place to start!

6) Track then Budget – We found that creating a budget within a vacuum of knowledge is tedious, unproductive, inaccurate and just no fun. For us, it was better to track income and expenses for three months and then develop a budget while asking questions such as: a) “Do we really need to spend money, or that much money, on that?”, b) “If we did this instead of that, could we generate more income?”, c) “Is how we’re handling our finances helping us achieve our business and personal goals?”

7) Income Tax – Each year, you need to file your personal income tax by April 30. If you carried on a business, you have until June 15 to file. BUT, regardless of your filing date, if you owe taxes resulting from business income, that amount still needs to be paid by April 30. Heather and I both file by the April 30 deadline. From personal experience, we found that dealing with CRA adjustments to family income after the June 15 deadline is just not worth the effort. By the way, we advise our business-for-self clients that it is not a question of if CRA will audit your tax filings, it is a question of when. Even though we were prepared for our tax audit several years back, it was still a time-consuming and onerous distraction from our regular business. And, yes, we passed our audit with no changes.

8) Store your Financial Information – Our financial information is stored both electronically and in paper files. We have backup systems in place for data storage in case of computer failure, fire or other disaster. For paper files, three years of information is readily accessible. The previous years’ information (up to 7 years) is archived outside the office. If we want to locate a particular piece of information, we first search QuickBooks and then, if necessary, locate the hardcopy by month in the paper folder.

Expertise

Over the past 12 years as a mortgage broker, I have had the privilege of speaking with thousands of Canadians about their debt and credit issues. My professional experience, both in BC and Alberta, has given me a deep understanding of how life events such as divorce, illness, job loss or business failure, can result in financial stress for both individuals and their families. For some, a home equity or consolidated loan can remedy their situation. For others, however, handling the accumulated debt requires another option.

Through Parley Consulting and its programs, I now have the tools and resources to help those struggling with debt and credit issues. Personally, it is very gratifying to witness Parley clients take control of their financial health, improving their lives - and the lives of those who depend on them.

We also have access to multiple choices of lenders from big banks to private. And, with our expertise in mortgage financing, we routinely go beyond quoting interest rates and calculate the total cost of borrowing for our clients. The care we take in serving our clients pays off for them when choosing the best mortgage option to fit their circumstances, now and into the future.

Strategy

What are your plans for the next five years or more? What will be your, or your family’s, source(s) of income? Will there be changes to your family structure - new family members arriving or current ones leaving your household? What are your plans for retirement? Do you own, or are you planning to own, more than one real estate property? If so, are your mortgages properly balanced across all properties in your real estate portfolio, including your principle residence?

The above are just some questions we may ask when helping you decide how to best handle your debt and credit – including how to best pay down your mortgage faster.

We encourage all our clients to chat with us annually about their debt and credit plans to explore how they could save money. A phone conversation with us followed by some minor adjustments could make a surprising difference in your monthly cash flow too!

What's the Next Step for You?

1) Keep us in mind and on hand in case anyone you know runs into the same sort of situaltion.

2) Share this post with your friends and family because you never know when the info could come in handy.

3) Call or Email Us just to connect and get started talking about your plans. (see below)

4) Sign Up for Glen's Perspective newsletter > Click here

Glen Kelleway, BSc, AMP, Senior Mortgage Planner & Owner

If you would like us to contact you by phone or email, please click Contact Us Kelleway Mortgage Architects will get back to you within one business day.

Phone: 604-476-0053

Toll Free within North America: 1-866-476-0053

Email: glen@mtgitright.com

(The first time you use this email address, please call first to validate yours. Otherwise, our SPAM filters will block your email and we will not see it.)

Join us on Facebook: > Click here

Blog Categories

- Main Blog Page

- Alt-A Lending Options (1)

- Announcements (18)

- Builder's Lien Removal (1)

- Community Relations (1)

- COVID-19 and Mortgage Deferral (8)

- Credit & Debt (15)

- Down Payment (2)

- Education and Courses (4)

- Financial Intelligence (17)

- Foreclosures (1)

- Fun Tips (52)

- Home Improvement (2)

- Legal Considerations (2)

- Line of Credit (LOC) (1)

- Mortgage Lenders (2)

- Mortgage Renewals (10)

- Mortgage Trends & Rates (14)

- Mortgage Types (13)

- Moving to Next Home (8)

- My Mortgage Planner App (5)

- Price per Square Foot (1)

- Prize Draw (41)

- Property Types (11)

- Purchase + Improvement (9)

- Qualifying for a Mortgage (14)

- Real Estate Contracts (2)

- Real Estate Market (12)

- Real Estate Taxes (7)

- Recipes & Serena's Tasty Tidbits (5)

- Relocation into Canada (1)

- Selling Your Home (3)

Blog Archives

- July 2022 (1)

- May 2022 (5)

- April 2022 (5)

- March 2022 (5)

- February 2022 (4)

- January 2022 (6)

- December 2021 (5)

- November 2021 (5)

- October 2021 (4)

- September 2021 (4)

- July 2021 (6)

- June 2021 (7)

- May 2021 (4)

- April 2021 (4)

- March 2021 (5)

- February 2021 (4)

- January 2021 (5)

- December 2020 (6)

- November 2020 (4)

- October 2020 (5)

- September 2020 (3)

- August 2020 (2)

- July 2020 (3)

- June 2020 (5)

- May 2020 (3)

- April 2020 (6)

- March 2020 (10)

- February 2020 (5)

- January 2020 (8)

- December 2019 (4)

- November 2019 (6)

- October 2019 (6)

- September 2019 (3)

- August 2019 (4)

- July 2019 (5)

- June 2019 (3)

- May 2019 (5)

- April 2019 (5)

- March 2019 (5)

- February 2019 (8)

- January 2019 (8)

- December 2018 (4)

- November 2018 (7)

- October 2018 (7)

- September 2018 (5)

- August 2018 (5)

- July 2018 (6)

- June 2018 (3)

- May 2018 (4)

- April 2018 (1)

- December 2017 (1)

- February 2017 (2)

- October 2016 (4)

- September 2016 (1)

- August 2016 (6)

- June 2016 (5)

- April 2016 (1)

- March 2016 (4)

- December 2015 (2)

- November 2015 (1)

- June 2015 (5)

- April 2015 (4)

- January 2015 (1)

- December 2014 (1)

- October 2014 (2)

- July 2014 (4)

- April 2014 (1)

- October 2011 (1)