MONTHLY PAYMENTS

A monthly payment schedule is exactly what it sounds like. One payment is made each month, usually on the same date. Twelve payments are made per year.

SEMI-MONTHLY PAYMENTS

Semi-monthly usually means that two payments are made each month. Many people stick with the traditional 1st and 15th but it’s possible to choose other dates if they make more sense for you financially. Twenty-four payments are made per year.

ACCELERATED BI-WEEKLY PAYMENTS

Accelerated bi-weekly payments are made every two weeks. The big difference here is those bi-weekly payments are made 26 times per year which is the same as one extra monthly payment, or 2 extra semi-monthly payments per year. The extra payments are applied directly against your principal thereby saving you interest and shortening the amortization of your mortgage.

Assuming that the mortgage payment was 300/month and the amortization was 300 months or 25 years. What would happen if you made accelerated payments either bi-weekly accelerated or weekly accelerated.

|

Monthly |

Semi-Monthly |

Bi-weekly Regular |

Bi-weekly Acc |

Weekly Regular |

Weekly Acc |

|

|

Months /yr |

12 in 12 |

12 in 12 |

12 in 12 |

13 in 12 |

12 in 12 |

13 in 12 |

|

Payments Per year |

12 |

24 |

26 |

26 |

52 |

52 |

|

If 3000 |

36000 |

36000 |

36000 |

39000 |

36000 |

39000 |

|

Effective Amortization |

25 years |

25 years |

25 years |

25 years |

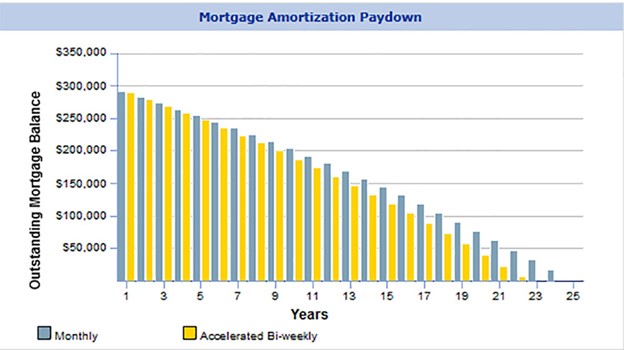

For those of you who prefer to see a picture, here’s a look at the difference between a monthly payment versus an accelerated biweekly payment.

With $300,000 mortgage @ 2.69% interest with a 5-year term over a 25-year amortization, the monthly payment would be $1372.45. The Accelerated bi-weekly payment is exactly half (i.e. $686.23). The two extra payments made annually reduce the effective amortization to 22.3 years, which is 2 years and 9 months earlier!